does texas have real estate taxes

All local governmental entities have the option. The federal estate tax.

Tac School Finance The Elephant In The Property Tax Equation

Property taxes or real estate taxes are paid by a real estate owner to county or local tax authorities.

. Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and uniform setting tax rates and collecting taxes. 1 or as soon. However you may owe money to the federal government.

If youre late in paying your property taxes youll be charged a late penalty. Pay your taxes on time. Tax collectors may start legal action to collect unpaid taxes on February 1.

There is no state property tax. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. Here are a few tips on how to avoid paying property taxes in the UK.

Texas has the sixth highest. Sales Tax on Real Estate Transfers. Property tax brings in the most money of all taxes available to local governments to pay.

Whether you have a 50000 or 5000000 house you will owe real property taxes in Texas. While the nations average property tax rate is 107 Texas homeowners have to pay much more. Does Texas have a state property tax.

The sales tax is 625 at the state level and local taxes can be added on. You will not owe any estate taxes to the state of Texas regardless of the amount of your estate. Texas Property Taxes Go To Different State 227500 Avg.

Property tax in Texas is a locally assessed and locally administered tax. Texas has only local property taxes levied by local taxing units. The rate increases to 075 for other non.

These are some of the most expensive Texas counties property tax-wise. The State of Texas imposes a sales tax on leases and rentals of most goods retail sales and some services. Real property tax is a system of taxation that requires owners of land and buildings to pay an amount of money based on the value of their land and buildings.

Its inheritance tax was repealed in 2015. 181 of home value Tax amount varies by county The median property tax in Texas is 227500 per year for a home worth the. How Is Your Property.

There is no minimum or maximum amount of real property taxes you could owe in Texas. Tax Code Section 3101 requires the assessor to prepare and mail a tax bill to each property owner listed on the tax roll or to that persons agent by Oct. However Texas residents still must adhere to federal estate tax guidelines.

The amount is based on the assessed value of your home and vary. Texas has no income tax and it doesnt tax estates either. Texas does not have a state estate tax or inheritance tax.

Property Tax Education Campaign Texas Realtors

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Homestead Exemptions 101 Jca Realtors North Texas Real Estate Professionals

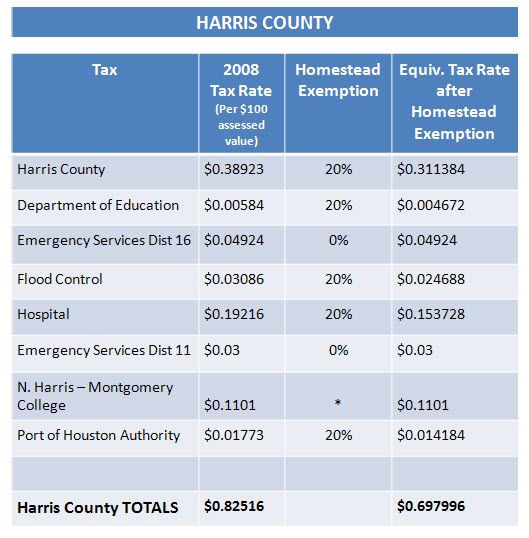

Who Has Lower Real Estate Taxes Montgomery County Or Harris County Discover Spring Texas

Two Property Tax Related Constitutional Amendments Will Be On The May 7 Ballot In Texas Tpr

Understanding Property Taxes In Texas Travisso Blog

Tax Information Mckinney Tx Official Website

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Texas Has Some Of The Highest Property Taxes In The Nation

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Property Texas Tax Texas Pride Realty

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

17 States With Estate Taxes Or Inheritance Taxes

Texas Property Tax Sales In A Hybrid Tax Deed State Ted Thomas

Property Tax Education Campaign Texas Realtors

Property Taxes By State How High Are Property Taxes In Your State

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Do Texas Governments Calculate Your Property Taxes Here S A Primer The Texas Tribune

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease